This kind of small business rarely survives the death or incapacity of its owner.Sole proprietors may experience a lack of technological advancement.It isn’t easy to attract investors and raise your capital.You are fully liable for all losses and debts.Although a self-employed individual has to pay unemployment tax on their staff members, they need not pay this tax on themselves.You are free from corporate standards and can make decisions that you consider are best for your small business.A sole proprietorship is a very flexible business form to change.You need to register your name and get local licenses. It is very easy and inexpensive to become a sole proprietor legally.There are apparent advantages of this type of self-employment: Writers, consultants, independent contractors, Uber drivers, or local small businesses such as coffee shops are all examples of what sole proprietorship may be.

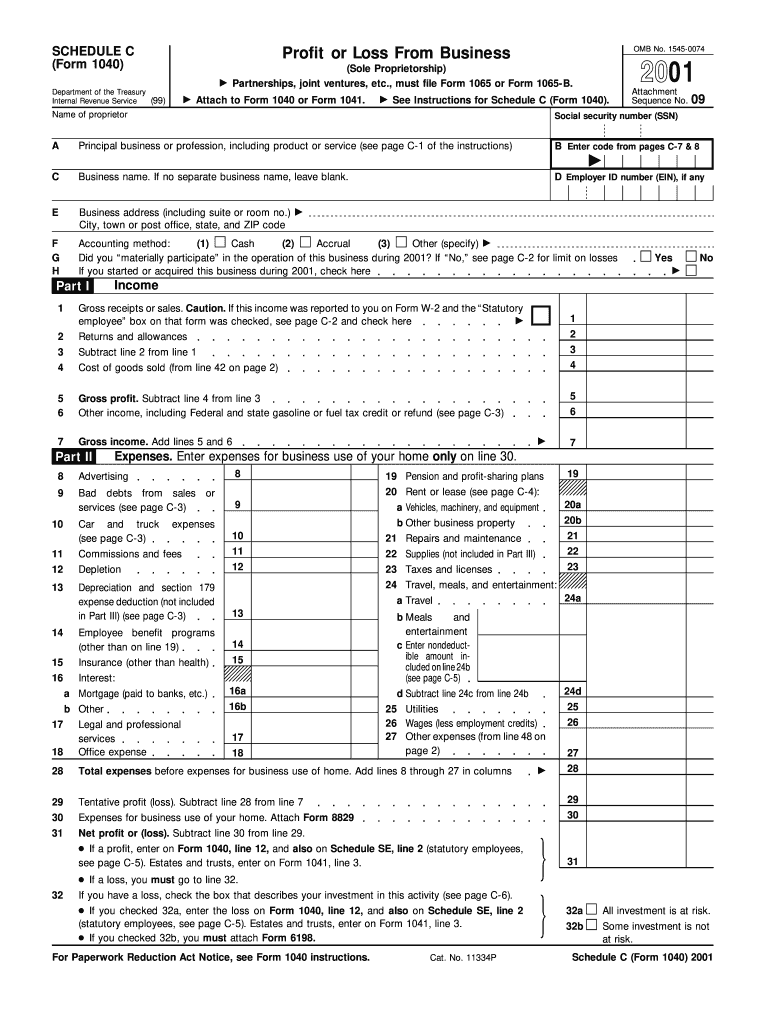

A sole proprietorship is an individual entrepreneurship that has nothing to do with legal entities, partnerships, and corporations. The self-employment status may not imply running a serious business. These forms are not the same, as a 1040 template is used by all taxpayers, no matter whether they are working in an organization or are registered as self-employed. The IRS Schedule C 2021 (also referred to as Profit or Loss from Business) is created to provide this information and is usually submitted along with the income tax return (Form 1040). This must be done if you own a single-member LLC and if you are a sole proprietor. Who Has to File a Schedule C?Īll the United States self-employed residents should report information about their income, as well as the losses from their business every tax year. One of the forms that are meant to help businesses decrease taxes is Form 1040. Various tax forms should be provided by US citizens to operate their companies legally and successfully. Sharing transparent, true, and correct information about the money you earn from your business is very important to maintain stability. Taxes are imposed on either individuals’ or enterprises’ assets.

Landlord (Tenant) Recommendation Letter.

0 kommentar(er)

0 kommentar(er)